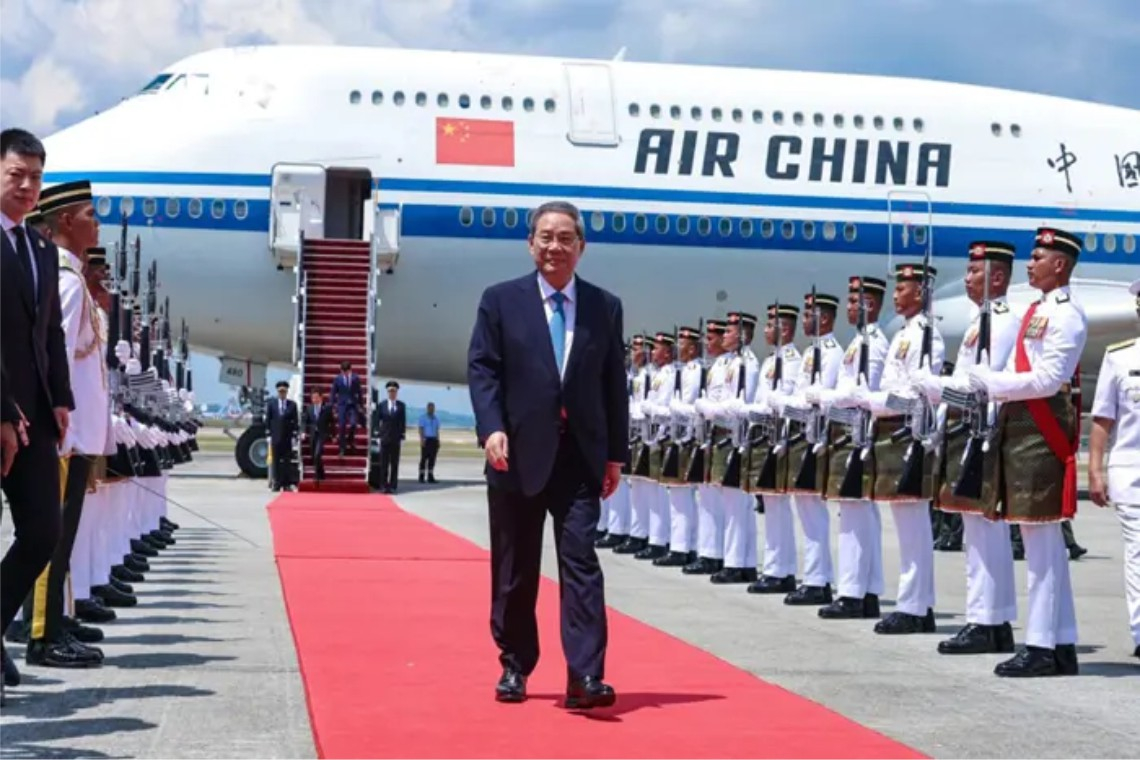

Premier Li Qiang arrives in Kuala Lumpur for the inaugural ASEAN–GCC–China Summit, reinforcing Beijing’s growing regional influence. Image Source: Bernama

At the May 2025 ASEAN–Gulf Cooperation Council (GCC)–China Summit held in Kuala Lumpur, Chinese Premier Li Qiang asserted that China is prepared to “align development strategies, promote connectivity, and safeguard regional peace and development.”

While couched in the language of mutual prosperity, China's increasingly assertive role in Southeast Asia—economically, diplomatically, and militarily—calls for heightened regional awareness. The ASEAN bloc now faces a pivotal decision: continue accommodating China's expansion or take deliberate steps—such as enhancing internal coordination, reinforcing regional trade frameworks, or setting stricter terms on foreign infrastructure deals—to safeguard regional sovereignty and strategic autonomy.

This decision is further complicated by the global power vacuum emerging from the United States’ retrenchment in the region. China has strategically responded to renewed U.S. tariffs—imposed by the Trump administration in early 2025—by rebranding itself as a stable and inclusive alternative partner. Premier Li Qiang reiterated China’s framing of regional cooperation as a means to withstand global instability—a message that implicitly contrasted Beijing’s approach with recent U.S. trade policies. This narrative gained traction amid drastic cuts to U.S. foreign aid. Executive Order 14169, signed in January 2025, suspended nearly all development assistance programs, leading to the widespread termination of U.S. foreign aid contracts. USAID operations were frozen, and over 90% of its programming was halted, including in Southeast Asia.

In Cambodia, U.S.-funded demining efforts were halted, and China filled the void with a $4.4 million support package. In Myanmar, the U.S. response to a 7.7-magnitude earthquake in March 2025 was markedly slow, allowing China to step in with immediate relief. This contrast is reshaping perceptions of reliability and shifting regional loyalty. Simultaneously, Chinese state media has expanded its language programming and presence across the region, capitalizing on the collapse of independent U.S.-funded outlets such as Radio Free Asia. The combination of U.S. retreat and Chinese opportunism is recasting the region’s information environment in ways that bolster Beijing’s narrative dominance.

Chinese state media has expanded its … presence across the region, capitalizing on the collapse of independent U.S.-funded outlets.

While China's deepening economic relationships across Southeast Asia—particularly through the Belt and Road Initiative (BRI)—predate recent shifts, these developments have taken on new strategic significance amid evolving U.S. engagement and the intensifying competition for regional influence. Although framed as development assistance, these investments often serve to advance Beijing’s broader strategic ambitions. This pattern becomes even more evident when examining China’s investment strategies across specific ASEAN countries.

Philippines: Pressure Beneath the Surface

In the Philippines, which has long held a cautious stance toward China due to maritime disputes in the West Philippine Sea, Chinese investment has nevertheless grown substantially. Between 2010 and 2023, Chinese firms committed nearly $22 billion in FDI, primarily targeting infrastructure development. Despite ongoing tensions, this makes China one of the Philippines' leading foreign investors—a dynamic that could weaken Manila’s leverage in security and sovereignty negotiations. President Ferdinand Marcos Jr. has publicly criticized Chinese maritime actions.

During the 2024 ASEAN Summit in Laos, he called attention to the “harassment and intimidation” by Chinese vessels. At the 2025 summit he further cautioned against unchecked Chinese expansion, stating, “We underscore the urgent need to accelerate the adoption of a legally binding code of conduct in the South China Sea. This is to safeguard maritime rights, promote stability, and prevent miscalculations at sea.” Nevertheless, deepening economic ties have created a precarious balance between sovereignty and dependency. China's investment strategy in the Philippines is concentrated in Luzon and Palawan—regions of strategic significance due to their proximity to contested South China Sea waters and U.S. military installations. This has heightened concerns that China is attempting to gain leverage in security-sensitive zones under the pretext of economic cooperation.

Deepening economic ties have created a precarious balance between sovereignty and dependency.

✉ Get the latest from KnowSulu

Updated headlines for free, straight to your inbox—no noise, just facts.

We collect your email only to send you updates. No third-party access. Ever. Your privacy matters. Read our Privacy Policy for full details.

Malaysia and Indonesia: Strengthening Economic Links

In Malaysia, China’s presence is increasingly prominent. In 2024, Chinese firms invested RM28.2 billion (US$6.4 billion), over 16% of Malaysia’s total approved foreign investment. Projects like the East Coast Rail Link offer China logistical access to the South China Sea and Strait of Malacca. While Prime Minister Anwar Ibrahim maintains ASEAN neutrality, the depth of Chinese involvement risks narrowing Malaysia’s long-term strategic options.

China’s influence is also expanding in Indonesia. The $7.3 billion Jakarta–Bandung high-speed railway and major investments in nickel processing and EV battery production in Central Sulawesi strengthen China's hold on critical supply chains. Partnerships with Chinese tech firms are embedding Beijing’s digital infrastructure into Indonesian systems. While Malaysia and Indonesia face growing economic entanglements, smaller or less politically influential nations are experiencing even deeper forms of strategic dependency. These engagements deepen Indonesia’s reliance on China in ways that increasingly intersect with national strategic interests.

Cambodia, Laos, and Myanmar: Strategic Entrenchment

Cambodia represents the most acute case of Chinese entrenchment. In 2024, nearly half (49.82%) of Cambodia’s total FDI originated from China, and bilateral trade exceeded $15 billion. During President Xi Jinping’s three-day state visit to Phnom Penh in April 2025, the two nations signed 37 agreements, covering everything from finance to energy to digital infrastructure. More concerning, however, is the military dimension of this relationship. China’s funding and renovation of the Ream Naval Base—widely viewed by U.S. and regional analysts as a potential site for permanent Chinese military presence—signals an alarming shift in the strategic balance in the Gulf of Thailand. Simultaneously, Chinese projects in Sihanoukville and Koh Kong offer Beijing access to deep-water ports and offshore resources, reinforcing its physical foothold in mainland Southeast Asia.

China’s funding and renovation of the Ream Naval Base… signals an alarming shift in the strategic balance in the Gulf of Thailand.

The Funan Techo Canal project in Cambodia - financed in large part by China and expected to cost $1.7 billion - amounts to more than 5% of Cambodia’s GDP. Environmental groups and civil society leaders have criticized the project for its ecological risks and potential to displace thousands of rural residents. China has framed the canal as part of its commitment to regional growth, with Premier Li Qiang stating, “External uncertainties must not be allowed to derail Asia’s path of progress.” Yet this rhetoric obscures a strategic aim: securing a bypass to Vietnamese waters and anchoring China's logistical reach into mainland Southeast Asia as a form of neocolonialism. The canal offers Beijing not just infrastructure, but increased dependency and leverage.

Elsewhere, the China–Laos railway, part of the Kunming-to-Singapore network, has reinforced Laos’ reliance on Chinese capital and transport. By 2023, Laos owed China more than $12 billion, or over two-thirds of its GDP. In Myanmar, the Kyaukphyu deep-sea port project enables Beijing to bypass the Strait of Malacca entirely, linking China directly to the Indian Ocean and expanding its energy and security corridor.

A Region at the Crossroads

These developments raise urgent questions about the long-term costs of economic alignment with China. ASEAN states risk becoming overly reliant on a partner whose strategic objectives are not aligned with the principles of regional autonomy or international law. This risk is exemplified by Laos’ mounting debt—over two-thirds of its GDP owed to China—and the expanding Chinese military footprint at Cambodia’s Ream Naval Base, both of which suggest deeper structural dependencies that could limit ASEAN’s ability to act independently. As former Indonesian Foreign Minister Marty Natalegawa emphasized, ASEAN must “seize the initiative in addressing emerging issues affecting its member countries—shaping and molding developments—and not allow such issues to spiral outside its control.”

To preserve sovereignty and regional balance, ASEAN member states could explore clearer transparency standards in foreign investment, enhanced collective bargaining mechanisms, and more diversified partnerships. They could also consider taking a firmer collective stance against coercive practices that undermine regional autonomy. Failure to act could see the region further embedded in a web of dependencies that compromise strategic autonomy.

The ASEAN bloc faces a moment of reckoning. What may appear today as infrastructure and development could tomorrow manifest as control and coercion. Recognizing the difference, before it is too late, will be essential to preserving an open, independent Southeast Asia.

REFERENCES

Council for the Development of Cambodia. (2024, January 13). 414 investment projects worth $6.9 billion approved in 2024. Khmer Times. https://www.khmertimeskh.com

Khmer Times. (2024, January 13). China remains Cambodia's largest FDI source. https://www.khmertimeskh.com/

Li, Q. (2025, May 27). Remarks by Chinese Premier Li Qiang at the ASEAN-China-GCC Summit. Ministry of Foreign Affairs of the People's Republic of China. https://www.mfa.gov.cn/

Malaysian Investment Development Authority. (2024, August 1). China's direct investment in Malaysia soars 28.8%, trade climbs 10.8% in first seven months of 2024. https://www.mida.gov.my/

Natalegawa, M. (2018). Does ASEAN matter? A view from within. ISEAS–Yusof Ishak Institute. https://doi.org/

The White House. (2025, January 20). Executive Order 14169: Reevaluating and realigning United States foreign aid. https://www.whitehouse.gov/